Accelerating corporate climate finance through carbon markets: overcoming the challenges

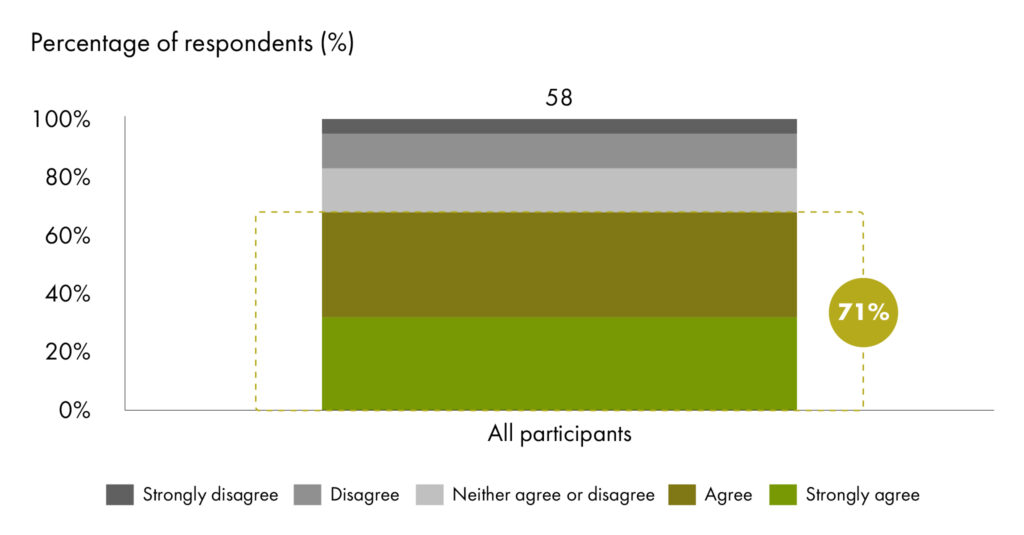

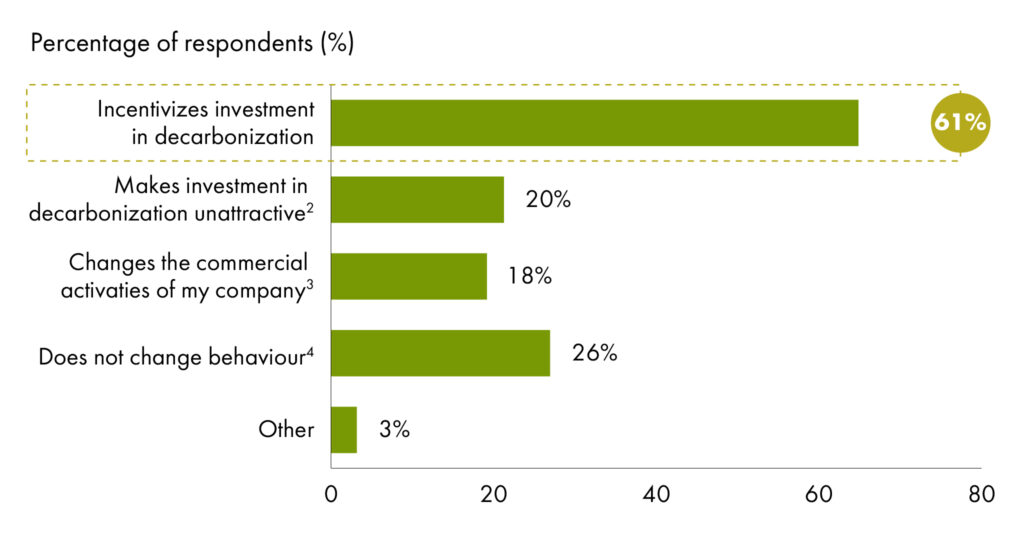

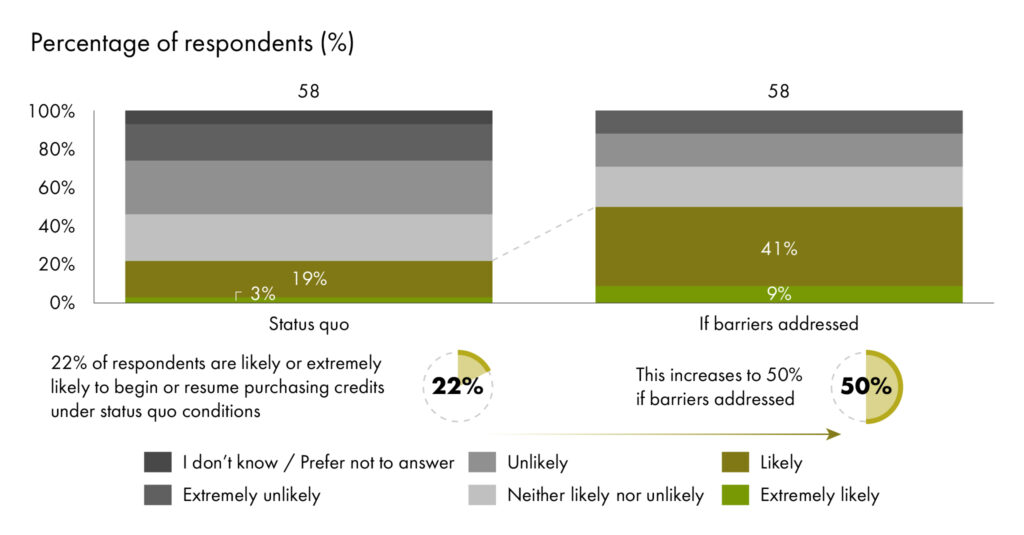

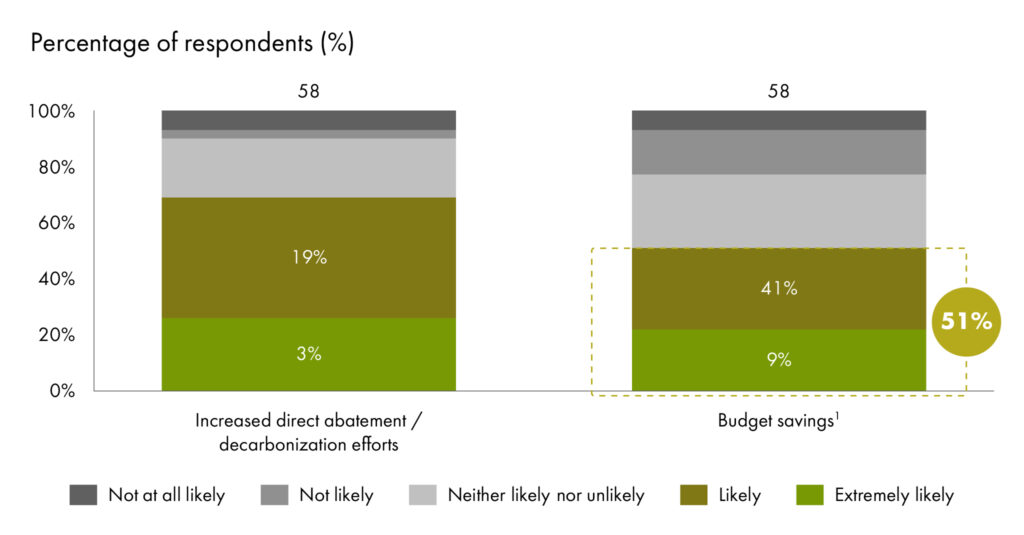

New research indicates that companies would substantially boost their climate investments if the corporate net-zero architecture recognizes and rewards investments in transparent, high-integrity carbon credits. However, they also seek greater confidence in the effectiveness of the carbon credits they purchase, ensuring they deliver tangible and meaningful results.

We Mean Business Coalition partnered with Intercontinental Exchange (ICE) and Bain & Company, to survey 180 executives from 27 countries across sectors including industry, technology and finance on corporate attitudes to the voluntary carbon markets (VCMs).

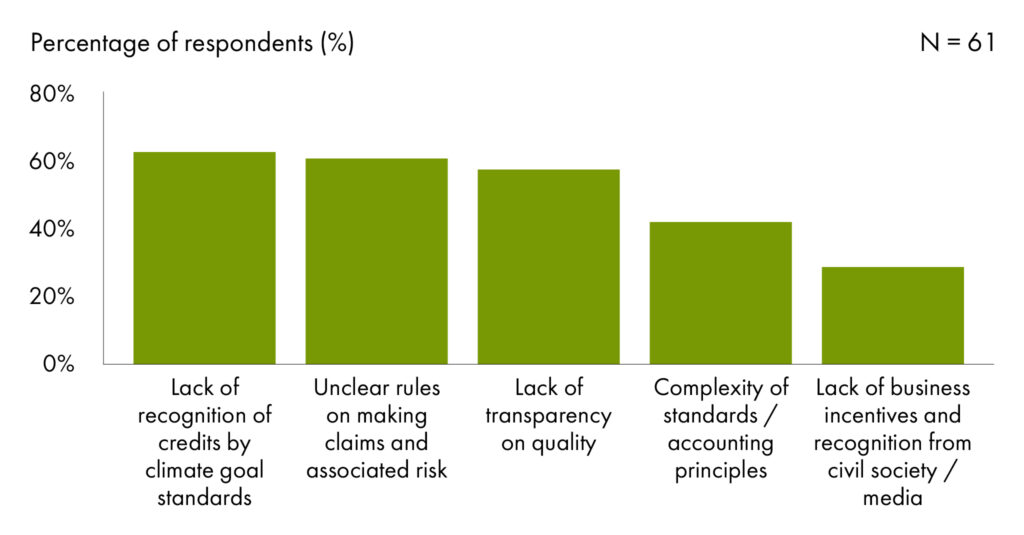

Our analysis finds that a lack of recognition and incentivization, coupled with questions over carbon market integrity are holding back corporate climate finance. But if barriers to access were addressed through more rigorous frameworks and regulation, companies would set more ambitious goals.