Sector-specific findings

In the run up to COP28, we will release the full series of in-depth, sector-specific findings.

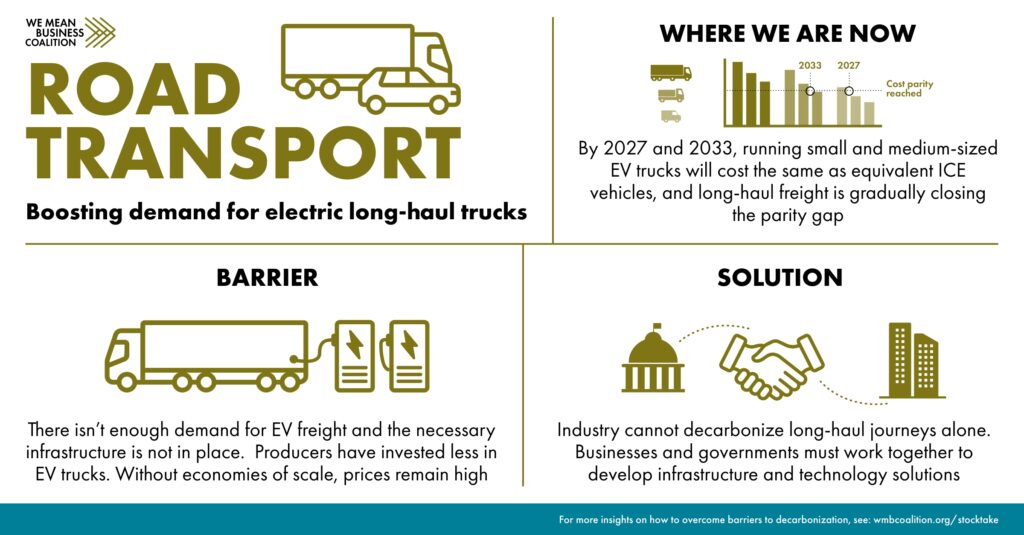

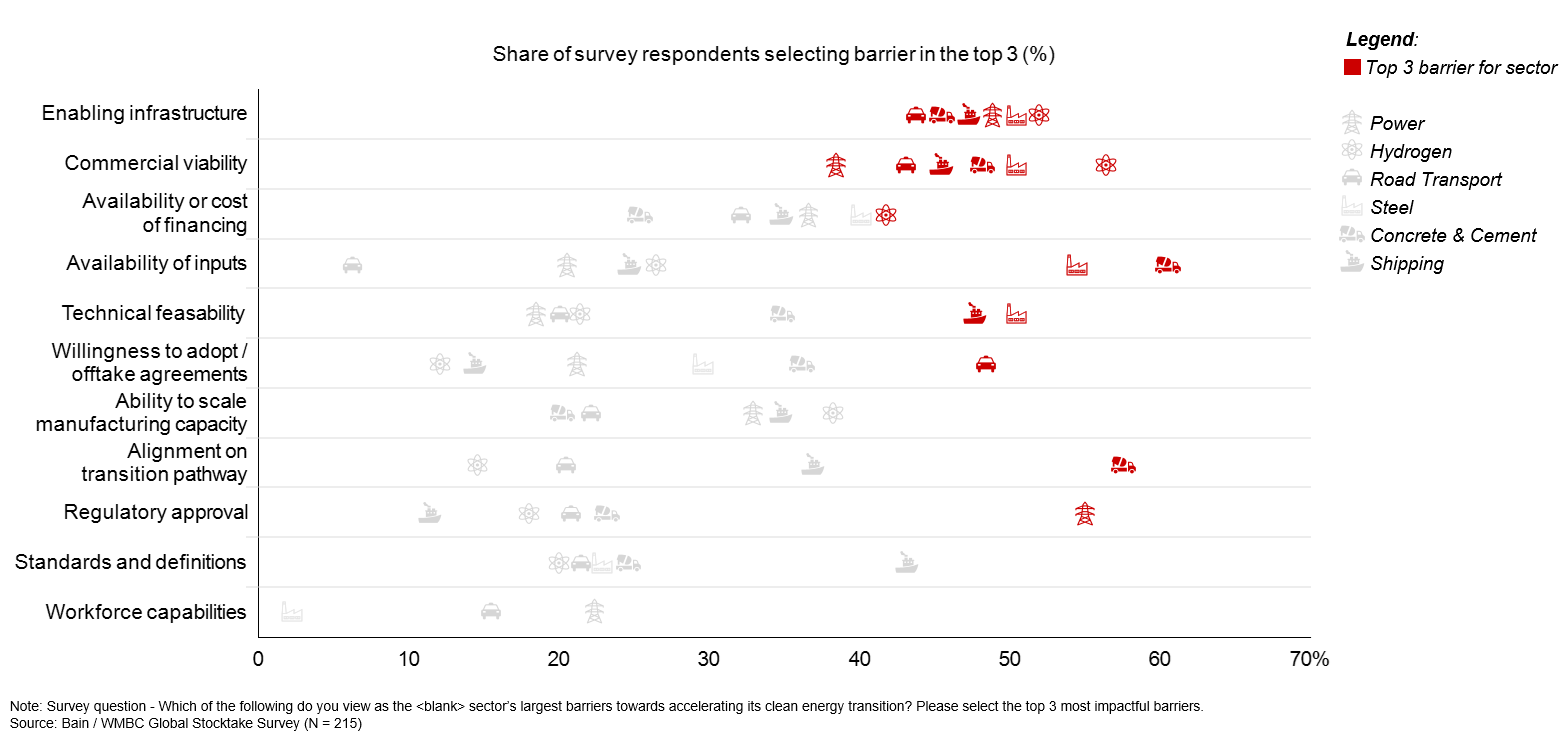

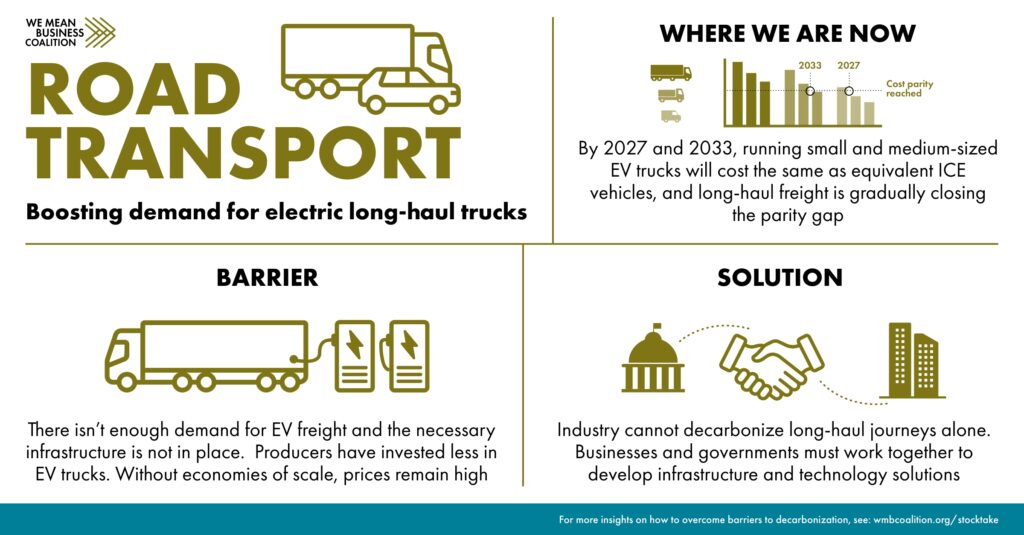

Road transport

Our analysis finds rapid progress in scaling passenger vehicle uptake in both the established markets of Europe, the US and China, as well as emerging markets, where electric cars are not common. However, financing, grid capacity and consumer interest pose challenges in developing economies, while strategic policy support and investment will be needed to overcome high costs in the road freight sector.

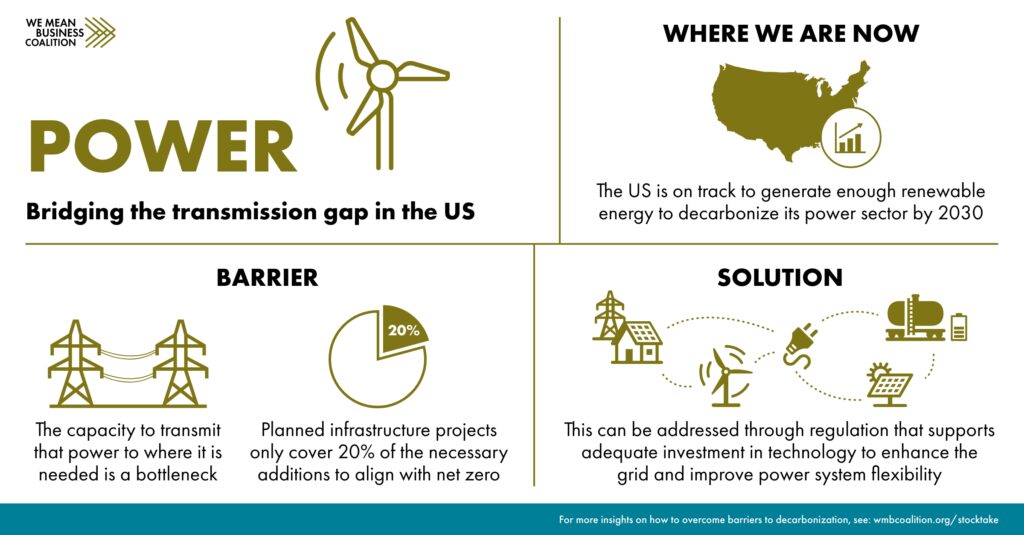

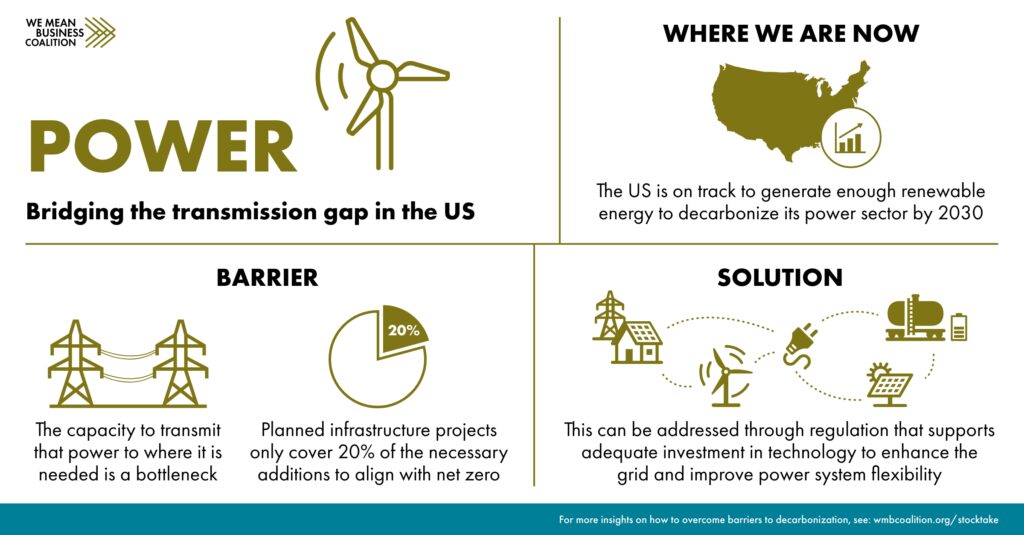

Power

Concrete and Cement

We examined opportunities for reducing emissions from the concrete and cement sectors – which currently account for ~7% of total GHG emissions. 88% of lifecycle emissions coming from one ingredient: clinker. Alternatives to clinker are already being developed by businesses but these are not yet at cost parity. As procurers of ~1/3 of the world’s cement, governments have a role to play in supporting and mainstreaming low-carbon alternatives.

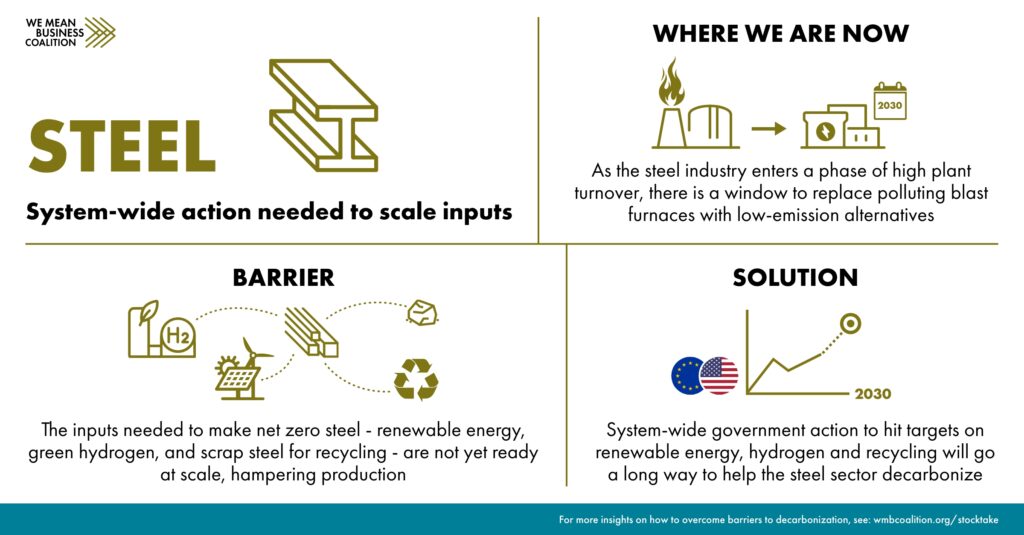

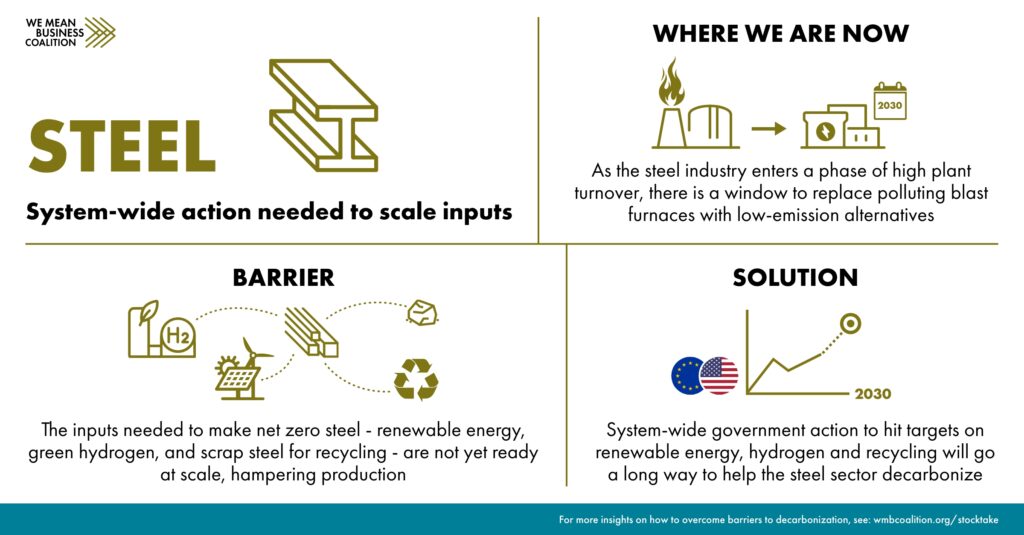

Steel

Globally, we are entering a period of high steel plant turnover. Construction decisions made today will have an impact years into the future. Now is the time to replace polluting blast furnaces with low emissions technology. Our analysis looks at how the industry can produce near zero-emission steel. But to do this at scale the inputs (green hydrogen, recycled scrap steel and renewable energy) must also be ready to scale. System-wide action to hit national targets on renewable energy, clean hydrogen and recycling are critical to steel system decarbonization.

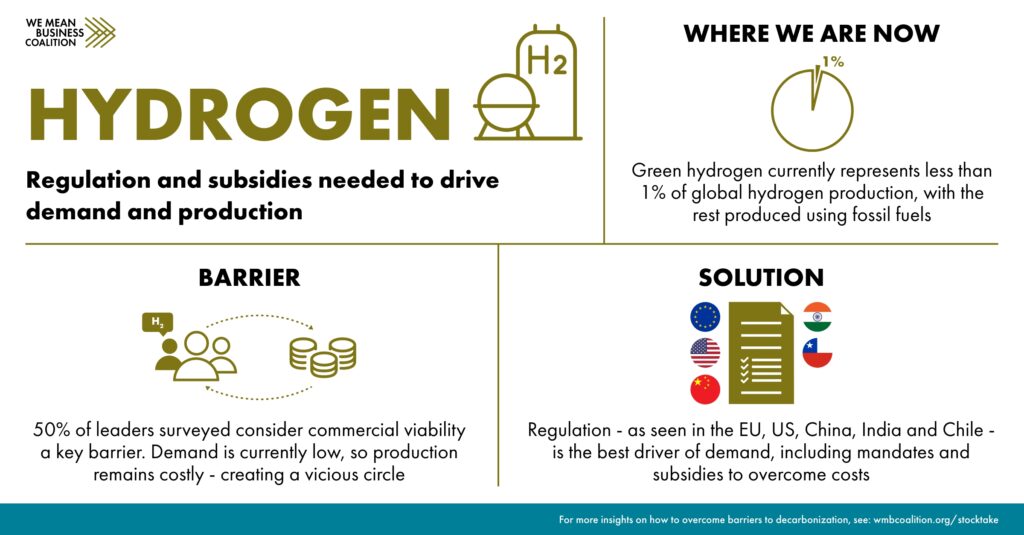

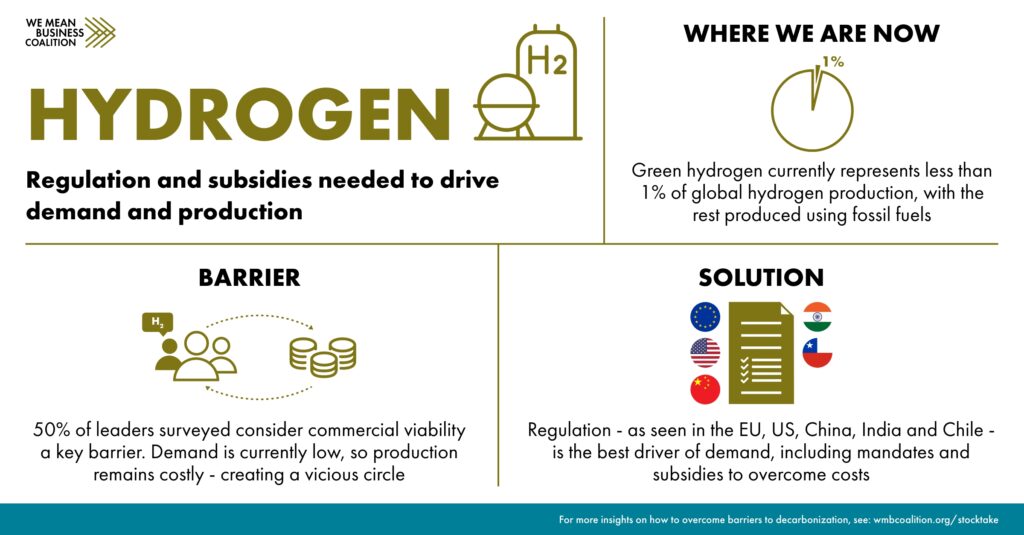

Hydrogen

Hydrogen plays a crucial role in the decarbonization of key industries such as steel, shipping, and freight. However, over 50% of surveyed leaders identify the commercial viability of green hydrogen and supporting infrastructure as major hurdles. Sustained government intervention is going to be essential for overcoming these barriers. Policies across shipping, aviation, and other industries are catalyzing global demand for green hydrogen, even as the more polluting alternatives remain cheaper to produce. Without these policies, companies may not be willing to invest in low-carbon hydrogen.

Download the full analysis: Global Corporate Stocktake -_Hydrogen (pdf)

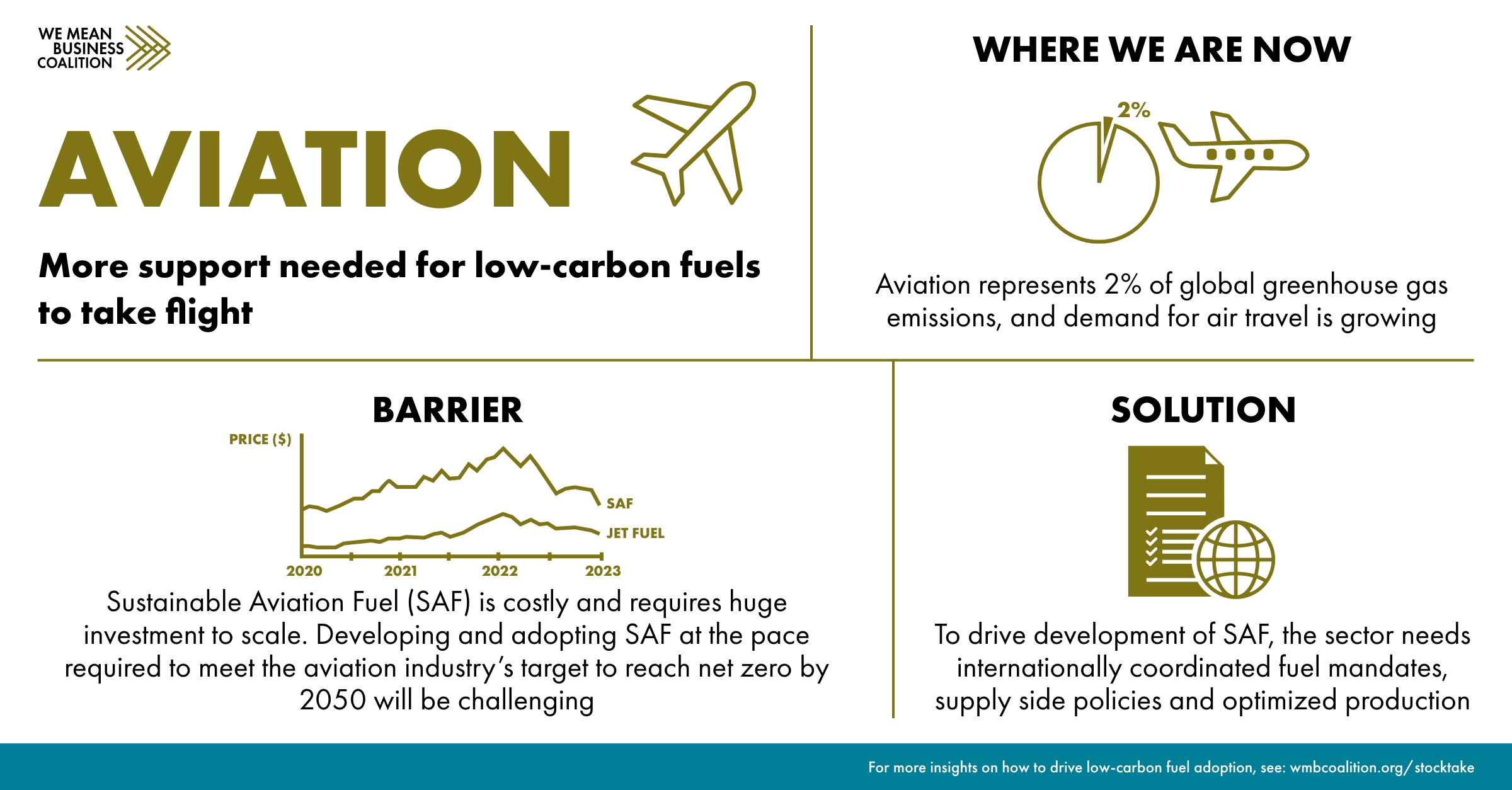

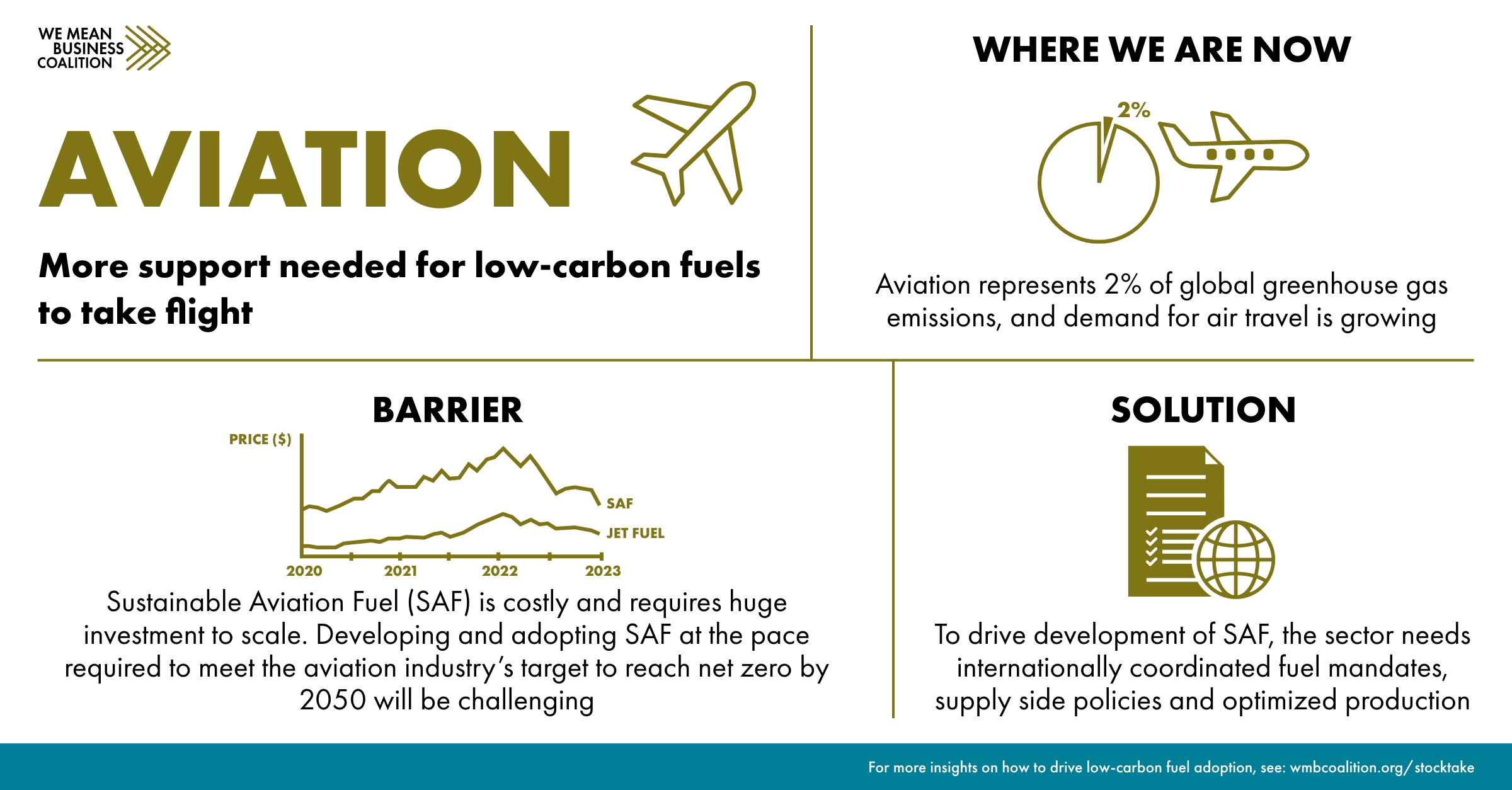

Aviation

Aviation as a sector represents 2% of global greenhouse gas emissions, and demand for air travel is growing. The research looks at the development of low-carbon Sustainable Aviation Fuel (SAF) as the only near-term solution to decarbonize aviation. Huge investment is needed to scale SAF if the industry is to meet its target to reach net zero by 2050. To ramp up SAF adoption, internationally coordinated fuel mandates are needed alongside supply side policies and optimized production.

Download the full analysis: Global Corporate Stocktake – Aviation (pdf)

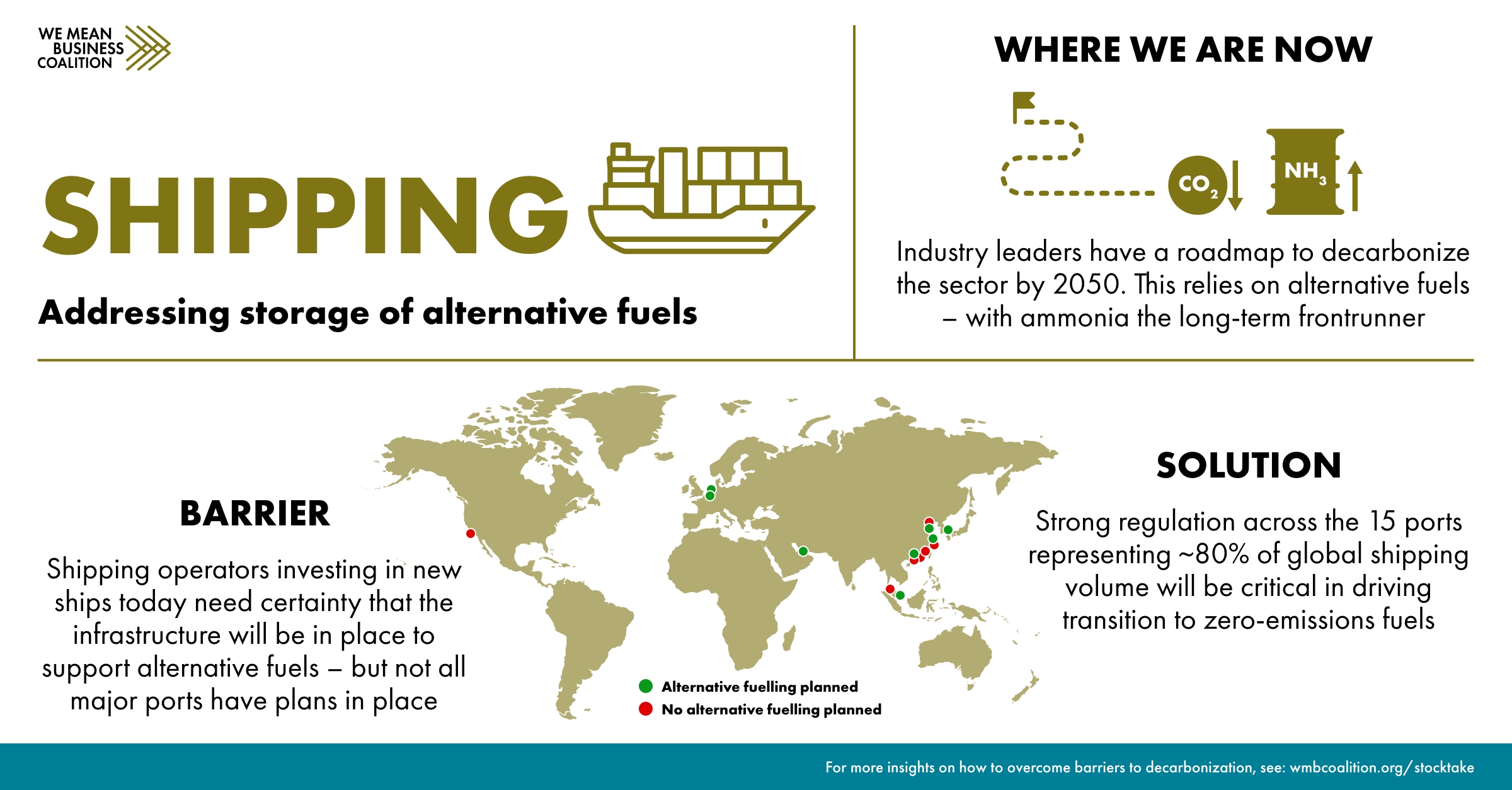

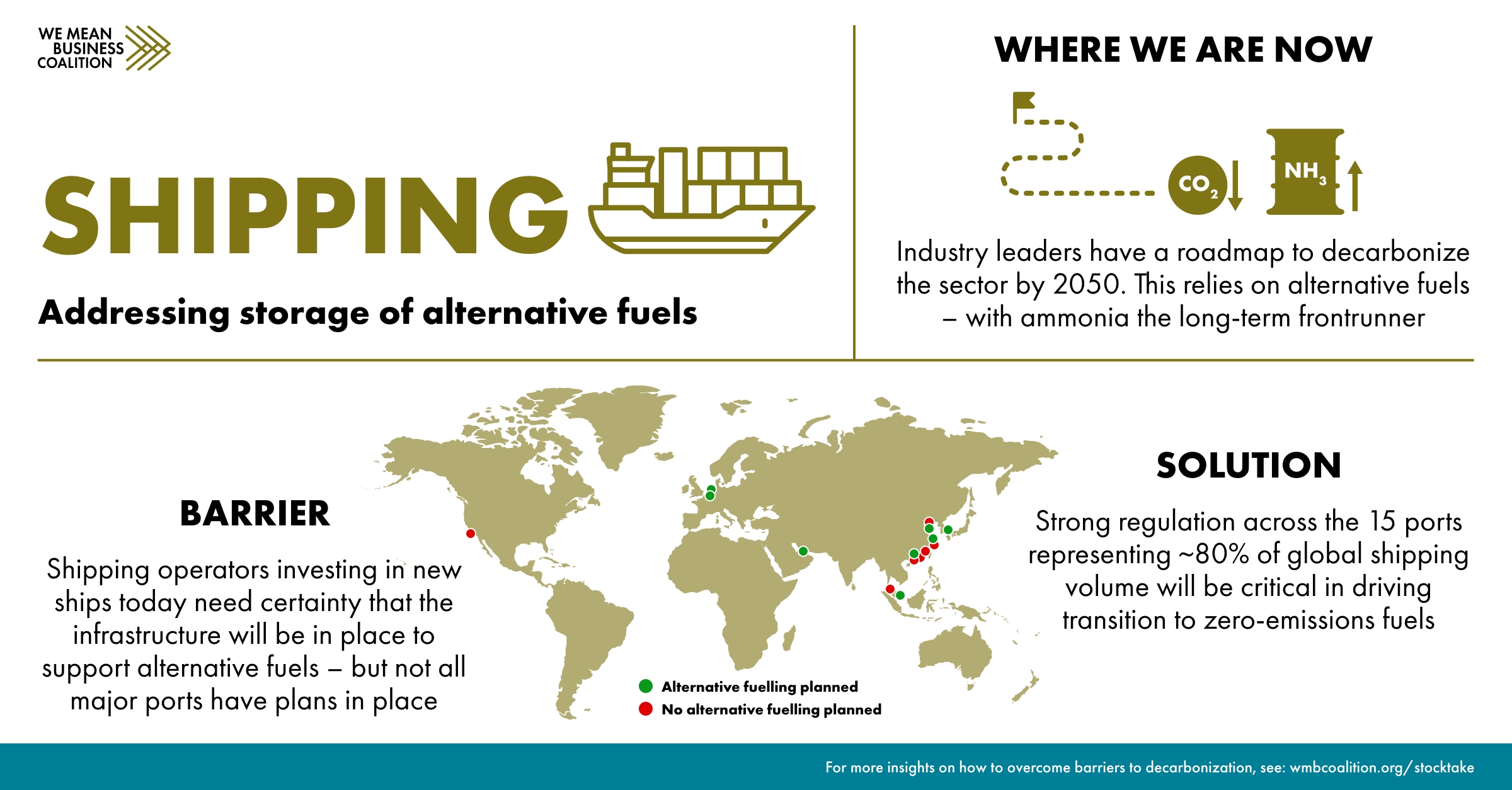

Shipping

Our research looks at the infrastructure development needed to allow the shipping industry to meet its goal to decarbonize by 2050. Shipping companies want to invest in new ships today but want to be assured that major ports have the infrastructure in place to support alternative fuels. Strong regulation is needed to ensure the 15 ports which handle 80% of the world’s shipping are equipped to drive the transition to zero-emission fuels.

Download the full analysis: Global Corporate Stocktake – Shipping (pdf)

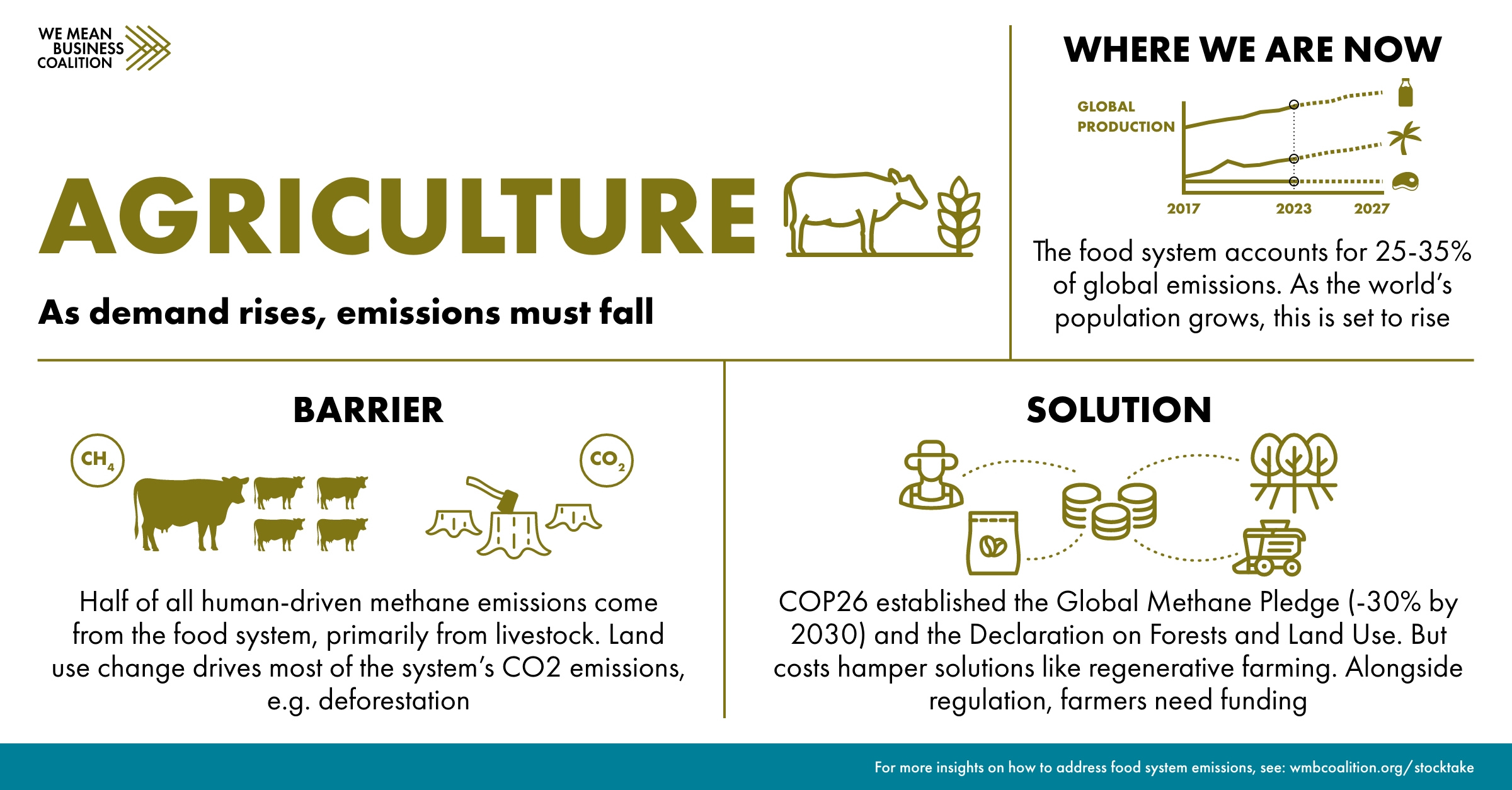

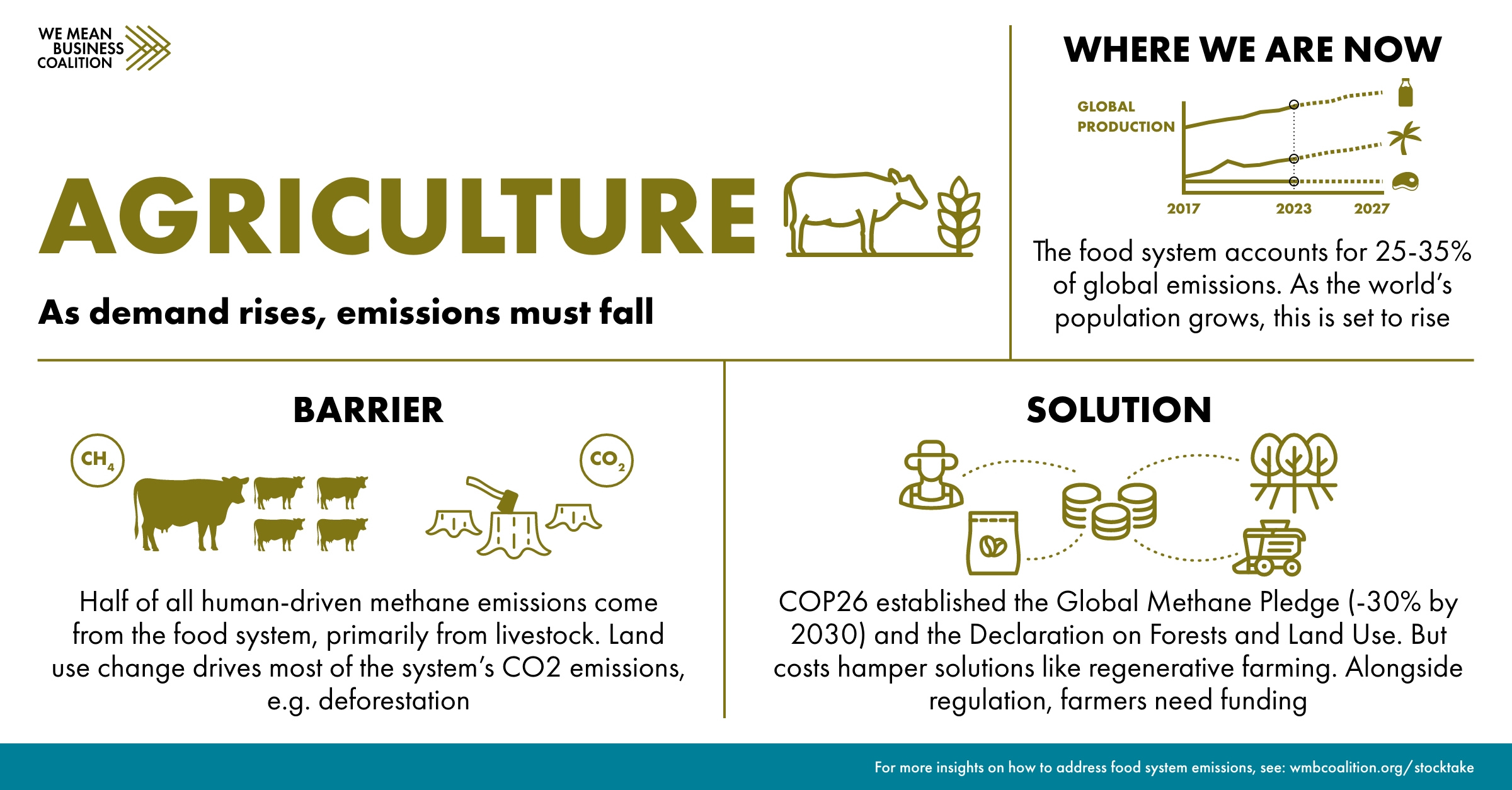

Agriculture

Today the food system makes up a striking 25-35% of global emissions, and this percentage is rising. The food system produces 50% of all methane emissions, primarily from livestock. While land use change like deforestation is driving most of the sector’s CO2 emissions. Regulation such as the Global Methane Pledge and the Declaration on Forest and Land Use is helping, but farmers need financial support to transition to lower-carbon practices such as regenerative farming.

Download the full analysis: Global Corporate Stocktake – Agriculture (pdf)